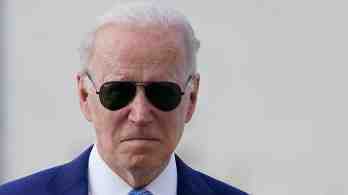

The White House announced Monday that Biden will facilitate a 24-month “bridge” for certain solar imports, allowing developers to pick up solar modules and cells from the four countries – Cambodia, Malaysia, Thailand and Vietnam – which together account for around 80 percent of panel imports to the United States

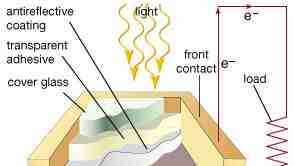

Biden will also give the Ministry of Energy permission to use DPA to rapidly expand US production of solar panel parts, such as the solar modules that convert sunlight into electricity, as well as building insulation, heat pumps, equipment to make and use clean electricity-generated fuel and power grid infrastructure as transformers.

“Together, these actions will stimulate domestic production,” a senior administration official told reporters on Monday. “It will set the tone for construction projects around the country that employ people who earn a good wage.”

Only the initiation of the investigation at the end of March and the threat of potential retroactive tariffs have caused extensive cancellations and delays of projects. The White House has faced pressure from both Democrats and Republicans to take steps to stop the fallout from the investigation, which trade officials have described as a process that leaves little room for Biden or Trade Secretary Gina Raimondo to weigh in directly.

The administration said Monday that the actions will not disrupt the ongoing trade investigation. “This administration has been steadfast in ensuring that the processes of implementing the enforcement of our commercial laws are carried out in accordance with these laws with integrity, and appreciates the quasi-judicial nature of the specific investigation,” the administration official said.

But the new actions have already received criticism from the small, California-based solar cell manufacturer that filed the first complaint that imports circumvented existing taxes.

“President Biden is significantly interfering in Commerce’s quasi-legal process,” said Auxin Solar CEO Mamun Rashid. “By taking this unique – and potentially illegal – action, he has opened the door to Chinese-funded special interests to fight for the fair application of U.S. trade law.”

The administration official objected to the president using emergency authority under existing commercial laws while the investigation continues, and that the action was developed in consultation with a broad inter-agency legal team, including the Ministry of Justice.

Faced with an attack by public pressure on the issue, the White House last month met with several Democratic senators who oppose the Department of Commerce’s investigation, and officials promised action soon to ease uncertainty for the solar industry.

The bid’s announcement Monday is a “much-needed deadline from this industry-shattering probe,” said Abigail Ross Hopper, president and CEO of the Solar Energy Industries Association, which has opposed the probe.

“The president provides improved business security today while harnessing the power of the Defense Production Act for tomorrow,” she said in a statement. “Today’s actions protect existing solar energy jobs, will lead to increased employment in the solar energy industry and promote a robust solar cell production base here at home.”

Roselund emphasized that the actions on Monday will have significant market effects, with prices for solar energy equipment expected to fall almost immediately and shipments will resume.

“This could save many solar projects that were in danger of being canceled and could [accelerate] the timelines of others who were delayed,” he said. “So this could lead to significantly more solar energy being installed this year and next.”

In addition, the White House announced the development of master supply agreements for domestically produced solar cell systems to increase the speed and efficiency with which domestic suppliers of pure electricity can sell their products to the US government and so-called super-preference status to apply domestic content standards. for federal procurement of photovoltaic systems.

Opponents of the trade inquiry – including governors from several states, more than 80 House Democrats and more than 20 senators – have called on Commerce to quickly issue a preliminary ruling in the investigation before the deadline in late August. The final decision in the procedure may eventually extend far into next year and may result in retroactive tariffs, the potential for this has triggered cancellations of projects and job losses in the United States.

Nevada Senator Jacky Rosen, who led the Senate’s letter opposing the investigation, applauded the White House “concrete action” in the case Monday.

“The risk of surcharges on imported solar panels would have been devastating for US solar projects, the hundreds of thousands of jobs they support, and the nation’s goals for clean energy and climate,” Rosen said in a statement. “The administration’s announcement is a positive step that will save U.S. solar jobs and invest in our own long-term domestic solar cell production.”

The trade investigation is being carried out by career employees, and Raimondo has claimed in a meeting with the pressure that her hands are tied to the inquiry. Instead, she has said that the department will proceed as quickly as the articles of association allow.

Proponents of her case have been working to make the actual transcript of this statement available online.

Late last month, six Democrats pressured the administration to continue with the trade investigation, and they complained that the “disturbing” lobbying against the investigation reached “mass hysteria”. United Steelworkers has also expressed concern that supporters of solar energy distorted how the investigation process works.

On Monday, Nick Iacovella, a senior vice president of the pro-production group Coalition for a Prosperous America, said the White House did not consult with U.S. solar cell manufacturers ahead of the announcements.

“You can not say that you want to stimulate domestic production, and then let the Chinese continue to dump products, which is a direct threat and something that counteracts increasing domestic production,” he added.

The White House has formulated the announcements on Monday as an attempt to increase solar energy production in the United States at a time when Hill’s efforts to provide tax deductions, including incentives aimed at US solar energy production, remain halted. Democrats are expected to restart work to adopt a party-line measure that will offer hundreds of billions of dollars in clean energy credits and incentives.

“Now that we have a deadline for the destructive effects of the trade inquiry, we look forward to working with the administration and our allies in Congress to ensure the implementation of guidelines that strengthen our domestic supply chain, such as the clean energy tax package currently being negotiated as provides advanced production tax deductions and long-term tax incentives for renewable energy, “said Gregory Wetstone, President and CEO of the American Council on Renewable Energy.

First Solar, an American manufacturer of solar panels, reiterated in its own statement that the White House did not consult American solar cell manufacturers and said that the action would benefit China’s state-subsidized solar industry.

“Such a proclamation directly undermines US solar energy production by providing unhindered access to China’s state-subsidized solar energy companies for the next two years. It sends the message that companies can circumvent US laws and that the US government will let them get away with it as long as they are supported by in-depth political press campaigns run by lobbyists, says First Solar’s Vice President of Global Politics Samantha Sloan said.

Sloan added that the use of DPA “is an inefficient use of taxpayers’ dollars and comes in handy under a sustainable solar energy policy”, such as the solar energy tax deductions that the administration has so far failed to deliver.

Monday’s actions are not the first time the president has tried to resolve tensions between the goals of clean energy and domestic production. The administration has previously considered banning the import of polysilicon, a critical solar panel material, from China’s Xinjiang region based on allegations of forced labor, and whether to extend Trump-era tariffs on Chinese shipments by four years.

Although solar energy initially costs to buy and set up, people find that solar energy is much cheaper than electric power in the long run due to the rising price of electricity.

Is there a federal tax credit for solar panels?

In December 2020, Congress approved an extension of the ITC, which provides a 26% tax deduction for systems installed in 2020-2022, and 22% for systems installed in 2023. (Systems installed before December 31, 2019 were eligible for a 30% tax deduction. Read also : Sunlight solar san diego.) The tax deduction expires from 2024 unless Congress renews it.

Do you get a tax deduction for solar panels? You can qualify for ITC for the tax year you installed your solar panels as long as the system generates power for a home in the United States. In 2021, ITC will provide a tax deduction of 26% for systems installed between 2020 and 2022, and 22% for systems installed in 2023.

How does the federal tax credit work for solar panels?

Federal Solar Tax Credit – December 2021 Update When installing a solar system in 2021 or 2022, 26% of the total project costs (including equipment, permit, and installation) may be claimed as a credit on your federal tax return. On the same subject : Efficiency limits of next-generation hybrid photovoltaic-thermal solar technology. If you spend $ 10,000 on your system, you owe $ 2,600 less in taxes the following year.

How does solar tax credit work if I get a refund?

Although the tax deduction will reduce your tax liability to $ 0, you will not be reimbursed for the extra $ 400 owed to you by the tax deduction. Solar Investment Tax Credit is non-refundable, so you must have enough solar tax liability available to receive the full value of this tax deduction.

How much money do you get back from solar panels on taxes?

In December 2020, Congress approved an extension of the ITC, which provides a 26% tax deduction for systems installed in 2020-2022, and 22% for systems installed in 2023. (Systems installed before December 31, 2019 were eligible for a 30% tax deduction.)

What is the solar tax credit for 2021?

Federal Investment Tax Credit (ITC) At the federal level, you will qualify for the Federal Investment Tax Credit for Solar Energy (ITC). In 2021, ITC will provide a tax deduction of 26% on the cost of installing solar panels, provided that your taxable income is greater than the credit itself.

How does the 2021 solar tax credit work?

When you install a photovoltaic system in 2021 or 2022, 26% of the total project costs (including equipment, permit and installation) may be claimed as a credit on your federal tax return. If you spend $ 10,000 on your system, you owe $ 2,600 less in taxes the following year.

What are the federal tax credits for solar?

The Investment Tax Credit (ITC), also known as the Federal Solar Energy Tax Credit, allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes. ITC applies to both residential and commercial systems, and there is no ceiling on the value.

Will Biden extend tax credits for solar?

President Biden renewed its commitment to expand the tax credit for clean energy in the state, including independent energy storage, which can increase investment in clean energy.

What is the federal tax credit for solar panels in 2020?

In December 2020, Congress approved an extension of the ITC, which provides a 26% tax deduction for systems installed in 2020-2022, and 22% for systems installed in 2023. (Systems installed before December 31, 2019 were eligible for a 30% tax deduction.)

How much can you write off for solar panels on taxes?

The Investment Tax Credit (ITC), also known as the Federal Solar Energy Tax Credit, allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes.

What is the solar credit for 2020?

Federal Tax Credit For Solar Installing a solar energy system in 2020 provides a maximum of 26% California solar cell tax deduction before being reduced to 22% in 2021. The federal government will offer: The tax deduction is 26% for solar cell systems. in use between 01/01/2020 and 31/12/2020.

Are solar panels improving?

The efficiency of the solar panel has improved dramatically over time, and panels continue to push new boundaries every year. At the same time, the cost of going to solar energy continues to decline. Start comparing custom solar power offerings on the EnergySage Marketplace to see potential savings.

Are solar panels becoming more powerful? In the US, home solar panel installations have fully recovered from the Covid downturn, with analysts predicting more than 19 gigawatts of total installed capacity, compared to 13 gigawatts at the end of 2019. Over the next 10 years, that number could quadruple, according to industry research data.

Will solar panels be obsolete?

Once installed, they will work well for many, many years. In fact, most are guaranteed to produce electricity for 25 years with very little deterioration. (Chances are they will last even longer. If you are interested in PV technology, check out the results of a solar cell owner’s test of his 30-year-old panels.)

Are solar panels becoming obsolete?

By 2030, outdated panels are expected to amount to 8 million tonnes, which will grow 10 times by 2050 to exceed 10% of all electronic waste globally.

What can replace solar panels?

Best solar panel options for your home

- Solar light.

- Solar tunnel.

- Solar Shingles.

- Solar ovens.

- Solar air conditioning.

- Solar water heater.

Why solar panels are not worth it?

Solar panels can not store power, so you will have reduced power consumption in cloudy weather and zero power consumption at night. Because of this, most solar cell systems in homes require a solar cell battery. You need to consider this extra cost when deciding if solar panels are worth it to you.

What is the future of solar panels?

Compared to the approx. The 15 GW solar energy capacity deployed in 2020 is the annual development of solar energy 30 GW on average at the beginning of the 2020s and grows to 60 GW on average from 2025 to 2030. Correspondingly significant development rates for solar energy will continue in the 2030s and beyond.

What is the future technology for solar panels?

Second-generation thin-film solar cells are one of the most promising PV technologies due to their narrow design (350 times less light-absorbing layer compared to standard Si panels), light weight, flexibility and easy installation.

Will solar panels be cheaper in the future?

Bloomberg and its 65 market specialists predict that the cost of solar energy in total will be reduced by about 34% by 2030. Although it is not entirely in line with the decline of 80% we saw from 2000 to 2020, it shows that the cost of going to solar energy is still moving in a downward direction.

How efficient will solar panels be in the future?

Retrieved from the April 2021 issue of Physics World. Members of the Institute of Physics can enjoy the entire edition via the Physics World app. For solar cells, efficiency really means.

How many solar panels do I need for a 2000 sq ft home?

So a home of 2,000 square feet will have a solar cell of 4,000 watts. Depending on the type of panel you choose, a system of this size will range from 12-18 solar panels.

How many solar panels are needed for a 2100 sq ft house?

How many solar panels does it take to run an average house?

How many solar panels does an average house need? With a home of approximately 1,500 square feet, it is estimated that 15 to 18 solar panels will be needed.

How many solar panels do I need to power a 3 bedroom house?

How many solar panels should supply an average household? Garrison stated that the typical home is about 1,500 square feet, with electrical costs of around $ 100 per month. Such a house generally needs around 16 panels to cover the power needs completely.

How many solar panels does it take to run a house off grid?

Most data suggest that a typical American home (2,000 square feet) uses approximately 11,000 kilowatt hours annually. So when we divide our total consumption by the expected performance of one solar panel, we see that about thirteen solar panels of this size will be enough to run a home of that size.

Can a house run on solar power alone?

With a modern solar energy system, including power storage, you can definitely run an entire house entirely on solar energy. Today’s highly efficient solar panels and solar cell batteries make it cheaper than ever before to run an entire home solely using solar energy.

Are solar panels going to get more expensive?

Costs for solar panels have remained flat since 2020, partly due to rising raw material prices and restrictions in the supply chain. It is unlikely that we will see significant price falls in the future as solar energy technology has matured.

Are solar panels becoming more expensive? An important selling point that made solar energy the fastest growing power source in the world – rapidly declining costs – has hit a speed bump. The prices of photovoltaic modules have risen 18% since the beginning of the year after falling by 90% during the previous decade.

Will solar panels get cheaper 2021?

Yes, but we see no added benefit in waiting any longer since most of the remaining cost components are difficult to shake. The report by Bloomberg New Energy Finance (BNEF) estimates that the price of solar energy will fall one third by 2030. This means that your investment of $ 2.7 / watt today will be $ 1.8 / watt after a decade.

How much do solar panels save in 2021?

Due to the current federal tax credit for renewable energy systems (26% of total system and installation costs), most customers will save over $ 3,000 if they go to solar in 2021 or 2022. So the actual customer cost of installing solar is (depending on the state ) $ 10,000– $ 14,000 – a national average of $ 12,000.

Is solar energy worth it in 2021?

Are solar panels worth it in 2021? The short answer: yes. Today’s solar panels on the roof are slim and can be integrated into the design of your home while you can produce your own energy.

Will solar panels ever get cheaper?

Bloomberg and its 65 market specialists predict that the cost of solar energy in total will be reduced by about 34% by 2030. Although it is not entirely in line with the decline of 80% we saw from 2000 to 2020, it shows that the cost of going to solar energy is still moving in a downward direction.

Will solar panels get cheaper in 2022?

In 2022, the price of electricity for homes is estimated to increase by an average of at least 3.8% compared to 2021 in the United States [3].

Is solar a good investment in 2022?

There is currently a 26% federal solar cell tax credit, called an investment tax credit (ITC), available to all homeowners who install solar panels in homes between 2020 and 2022. This means that 2022 is pretty much your last chance to take advantage of the 26% tax incentive.

Is solar energy becoming cheaper?

The report follows the International Energy Agency’s (IEA) conclusion in its World Energy Outlook 2020 that solar energy is now the cheapest electricity in history. The technology is cheaper than coal and gas in most large countries, the outlook shows.

Will solar panels be cheaper in the future?

Bloomberg and its 65 market specialists predict that the cost of solar energy in total will be reduced by about 34% by 2030. Although it is not entirely in line with the decline of 80% we saw from 2000 to 2020, it shows that the cost of going to solar energy is still moving in a downward direction.

Are solar panel costs going down?

The installed costs of solar cells (PV) and battery storage systems continued to fall between 2020 and 2021 in the US, with solar cell systems in use scale seeing a price decline of 12.3%, according to a new report from the National Renewable Energy Laboratory (NREL)).

Are solar panels becoming less expensive?

The age-old question: Are solar panels getting cheaper? Our quick answer to you is YES. Manufacturers have already made solar energy cheaper by 80% since 2000 and will continue to drive prices down further. However, ClimateBiz experts recently found that the pace of price reductions has slowed.