The House of Representatives is expected to pass the Democrats’ long-awaited climate, tax and health care bill, the Inflation Reduction Act, on Friday. This historic law offers many energy efficiency incentives for taxpayers. The bill includes tax breaks for people who buy clean vehicles and residential solar projects.

What You Need To Know

The bill includes tax credits for people who purchase clean vehicles and residential solar projects More than 1.1 million additional rooftop and solar panels will be installed due to the solar tax credits in this bill in Florida alone, the White House says Solar power accounted for roughly 54% of all new “electricity-generating capacity” added in the US for the first three quarters of 2021, according to a solar industry association The climate, tax, and health care bill, the Inflation Reduction Act is expected to pass through the House of Representatives on Friday

About 4% of US homes use residential solar systems. Residential solar accounted for roughly 54% of all new “electricity generating capacity” added in the U. See the article : Fluent solar san diego.S. in the first three quarters of 2021, according to the Solar Energy Industries Association, a trade association.

Floridians are joining in, too. Doug Nelson of Hillsborough County said he is in the final stages of installing new solar panels to power his home in Florida. His panels cover about 800 square feet of his roof and is a project he says he’s been looking forward to finishing for years.

“He’s pretty handsome. It turned out better than I thought,” Nelson told Spectrum News.

Nelson said he has a “lifelong” interest in solar energy and that as a child he “won a science fair with a solar-powered doghouse.” He mentioned that he was a child of the “oil crisis of the 70s”.

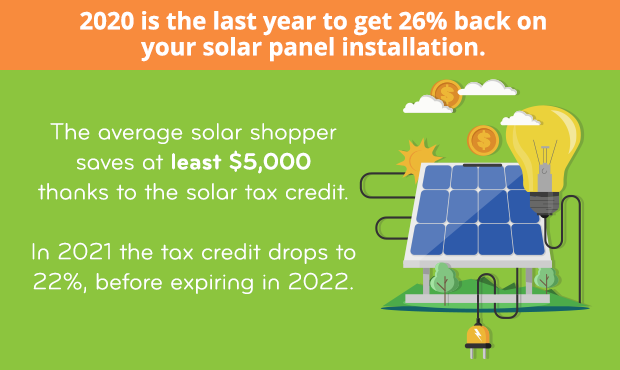

He says he finally decided to go solar because the 26% federal tax credit was set to expire at the end of next year. That’s an incentive that will translate into roughly $6,000 in savings. The Democrats’ climate, health and tax bill nearing passage in Congress would increase the tax credit to 30% and extend it beyond 2023.

“Even more Americans will be motivated to install solar panel systems for their homes,” White House National Climate Advisor Gina McCarthy told Spectrum News.

More than 1.1 million additional rooftop and solar panels will be installed because of the solar tax credits in this bill, the White House says, in Florida alone.

Nelson worked with the nonprofit Solar United Neighbors to get a better price on the equipment and some education. The organization says that on average, home installations in Florida can run from about $7,000 to $20,000 before tax credits and local incentives.

Solar United Neighbors says the national average for the number of solar panels on a home is about 15 to 17, but that depends on the home’s size, electricity use and geographic location.

Nelson estimates that his system will save him about $120 in overhead costs per month and that the project will pay for itself in 10 years.

He also says he wants an electric vehicle for his family fleet, and the return on investment will happen even faster.

Do solar panels Increase home Value?

According to several studies, property values will increase between 3% to 4% when solar panels are installed. This may interest you : the rise of solar power. However, some factors will affect the increase in the value of your property, such as: Where your property is located. Installation size.

Do Solar Panels Increase Home Value in 2021? The simple answer is yes, installing solar panels on your home generally increases its value.

Do solar panels increase the value of a home?

According to the Appraisal Journal, a home’s value increases approximately $20 for every $1 reduction in energy costs. If solar panels save a household $600 a year on their electricity bills, the value of that home could increase by $12,000.

How much value do solar panels add to your house?

How do solar panels increase home value? The energy savings provided by solar panels translate into better value for your home. The National Renewable Energy Laboratory (NREL) found that every dollar saved on energy through solar increases the value of a home by $20. That’s a 20-to-1 return on investment.

Do solar panels hurt the resale value of your home?

Installing solar panels in your home not only helps reduce your current monthly utility bills; can potentially increase a home’s value by up to 4.1% more than comparable homes without solar panels, according to a recent solar study by Zillow â or an additional $9,274 for the median U.S. home.

Do appraisers add value for solar panels?

Financed (panels as personal property) ⢠May not provide value of solar panels that contributes to appraised value, as panels are collateral for other debt. Leased or covered by a power purchase agreement • May not include the value of solar panels in the assessed value of the property.

Do appraisers give value to solar panels?

If the homeowner owns his solar panels, the lender treats them as real property, that is, as part of the home – which means they can be valued in the appraisal.

Do solar panels increase home resale value?

Installing solar panels in your home not only helps reduce your current monthly utility bills; can potentially increase a home’s value by up to 4.1% more than comparable homes without solar panels, according to a recent solar study by Zillow â or an additional $9,274 for the median U.S. home.

What adds the most value to an appraisal?

The quickest and easiest way to increase your chances of a higher appraisal is to paint, which can take years off an outdated house. If you have crayon marks on your walls and a mess on your floors, a fresh coat of paint and some simple organizing will make a good impression when the appraiser visits.

How much money can you make selling electricity back to the grid?

So how much money can you make selling electricity back to the grid? Since prices vary based on the market value of electricity, there is no exact dollar figure you can expect to take home. However, many domestic producers earn about $3,000 a year through a combination of REC sales and government clean energy incentives.

Can you make money selling energy back to the grid? But did you know that you can also earn money from the electrical industry? This includes selling electricity back into the company’s grid, if you have excess from your renewable energy source. So if you’re thinking about generating renewable energy on your property, those solar panels can make you money.

Can I generate and sell electricity?

Assuming your house is connected to the national grid, you can sell the excess electricity you generate back to your energy supplier (although it can sometimes be difficult to do the paperwork). Selling electricity is one of the best ways to earn passive income for your household.

How does selling energy work?

You pay the retail price for the electricity you use, and the electricity supplier buys your excess production at the avoided price (wholesale price). There can be a significant difference between the retail price you pay and the avoided cost of the electricity supplier.

How much does it cost to generate your own power?

At approximately $3.26 per thousand cubic feet, operating costs will vary depending on the size of the generator, ranging from $20 to $40 per day: 7 kilowatt portable generator: uses up to 118 cubic feet/hour, costs about 0.82 USD/hour of operation.

How much do I get for selling electricity back to the grid California?

They estimate that the real value for the grid is about 5 cents per kW. But someone with a home solar system could make 30 cents per kW because they sell it at retail price, which is higher because it includes costs like grid maintenance.

How much does PG&E pay back for solar?

The rate is set by the California Public Utilities Commission at approximately two to four cents per kilowatt-hour (kWh). As a private customer of rooftop solar, you don’t need to do anything to get reimbursed.

Does California buy back electricity?

California Assembly Bill 920 allows PG&E and other state utilities to offer payment for excess energy that your home or business’s renewable energy systems send back to the power grid.

How much do you get for selling back to the grid?

Selling energy to the grid involved a lot of red tape, and many solar PV system owners found it too much hassle. If you were able to install your export meter and feed your electricity back to your supplier, you were usually paid between 6p and 9p per kWh back.

How does selling electricity back to the grid work?

The meter spins forward as you draw electricity, and spins backwards as the excess is fed into the grid. If at the end of the month you used more electricity than your system produced, you pay the retail price for that extra electricity.

How much electricity can I send back to the grid?

One REC is issued for every 1000 kilowatt hours (kWh) of energy fed back into the grid. PURPA requires utilities to purchase a certain amount of electricity from renewable sources. RECs essentially serve as proof that they have fulfilled that obligation.

How much money can you make selling electricity back to the grid in Ohio?

For every megawatt hour (MWh) of electricity your solar panels produce, you’ll get one SREC that you can sell for extra cash. In 2021, these certificates were selling for around $10, meaning an 8 kilowatt system producing 8 MWh per year could earn an additional $80 per year.

Is the solar tax credit a refund?

The solar investment tax credit is nonrefundable, so you must have enough available solar tax liability to get the full value of that tax credit. However, there are options available if you do not have enough solar tax liability in one tax year.

How does the federal solar tax credit work? Federal Solar Tax Credit â December 2021 Update When you install a solar system in 2021 or 2022, 26% of your total project costs (including equipment, permits and installation) can be claimed as a credit on your federal tax return. If you spend $10,000 on your system, you owe $2,600 less in taxes next year.

How much money do you get back from taxes from solar panels?

In December 2020, Congress passed an extension of the ITC, which provides a 26% tax credit for systems installed in 2020-2022 and 22% for systems installed in 2023 (Systems installed before December 31, 2019 were eligible for a 30% tax credit credit.)

Is there a tax credit for solar in 2022?

The 2022 Solar ITC offers system owners a tax credit worth 26% of the total cost of the solar installation, including all parts and labor. So if you bought a solar system that cost $10,000, you would qualify for a $2,600 credit that you could apply to your next IRS bill.

Is the 26% solar tax credit refundable?

This is a non-refundable tax credit, meaning you will not receive a tax refund for the amount of solar tax credit that exceeds your tax liability. However, you can carry forward any unused solar tax credit amount to the next tax year.

Do you get solar tax credit back?

However, you don’t get any part of the tax credit as money back in your tax refund. For example, if you have a $19,000 solar system installed, the 26% tax credit saves you $4,940 on your federal tax return the same year the system is activated. This way you are technically paying $14,060 for your solar system.

Is the 26% solar tax credit refundable?

This is a non-refundable tax credit, meaning you will not receive a tax refund for the amount of solar tax credit that exceeds your tax liability. However, you can carry forward any unused solar tax credit amount to the next tax year.

How do I claim back solar tax credit?

Solar Tax Credit Claim Requirements You can instead carry the credit over to the next tax year. If you failed to request a loan in the previous year, you can submit an amended application for requesting a loan.

Is the solar tax credit a refund?

The solar investment tax credit is nonrefundable, so you must have enough available solar tax liability to get the full value of that tax credit.

How does the federal solar tax credit work IRS?

The solar investment tax credit is a credit you claim on your federal income tax. ITC is not a tax credit. Instead, it reduces what you owe in taxes. This credit applies to costs associated with installing a solar photovoltaic (PV) system in that tax year.

How do I claim back solar tax credit?

Solar Tax Credit Claim Requirements You can instead carry the credit over to the next tax year. If you failed to request a loan in the previous year, you can submit an amended application for requesting a loan.

How do I add solar credit to my tax return?

Solar Tax Credit Claim Requirements To claim the credit, you must file IRS Form 5695 as part of your tax return. You will calculate the credit in Part I of the form and then enter the result on your 1040.

Do you get solar tax credit back?

However, you don’t get any part of the tax credit as money back in your tax refund. For example, if you have a $19,000 solar system installed, the 26% tax credit saves you $4,940 on your federal tax return the same year the system is activated. This way you are technically paying $14,060 for your solar system.

What documents are needed for solar tax credit?

Claiming ITC is easy. To get started, you’ll first need your standard IRS Form 1040, IRS Form 5695, âResidential Energy Creditsâ and instructions for Form 5695. The purpose of Form 5695 is to confirm your qualification for Renewable Energy Credits.

Does Florida have a free solar program?

Most Floridians qualify for the federal Solar Investment Tax Credit—also known as the Solar ITC. This allows qualifying homeowners to deduct up to 26% of their solar panel installation costs from their federal income taxes. Many Florida homeowners also bundle battery storage with their solar panel system.

How much does it cost to install solar panels in FL? The average cost of installing solar panels in Florida ranges from $10,795 to $14,605. On a cost per watt ($/W) basis, solar panel installations in Florida range from $2.16 to $2.92.

Can you still get free solar panels?

You must have certain benefits and live in a certain type of property to be entitled to free solar PV panels. Not everyone who is eligible will receive free solar panels because each energy company has a limited number of grants. Only some energy companies participate in the free solar panel scheme.

Can I get free solar panels UK?

Can I get free solar panels in the UK? Companies have offered free solar panels in the past, but this service is no longer available in the UK. As solar panels become more affordable, the government has drastically reduced the Feed-In Tariff (FIT).

Will solar panels ever be free?

There is no such thing as free solar panels and there is no such thing as a free solar program. If you hear about “free” or “free solar programs,” you’re probably being fed cheap advertising to get you to sign a solar lease or power purchase agreement.

Is the US government giving out free solar panels?

ANSWER No, the federal government does not give out free solar panels. There are private companies that offer to install solar panels on homes for free, but the homeowner just rents the panels and still has to pay for their electricity.

Can you get solar panels for free in Florida?

There are currently no programs that offer free solar installations in Florida. However, you can go solar for $0 up front by getting a loan or signing a lease or power purchase agreement. This way, you can start saving on your electricity bills immediately, and these savings can be used to pay off your loan/lease/PPA.

Can you still get free solar panels?

The companies offered to lease your roof space for up to 25 years, with free care for the installation and maintenance of the solar panels. In return, these companies would collect money from the FIT. This way you get free solar panels for your home.

Does Florida offer solar incentives?

Most Florida residents qualify for the Federal Solar Investment Tax Creditâalso known as the solar ITC. This allows qualifying homeowners to deduct up to 26% of their solar panel installation costs from their federal income taxes. Many Florida homeowners also bundle battery storage with their solar panel system.

What is the average cost for solar panels in Florida?

What is the average cost of solar panels in Florida? Price estimates show solar panels in Florida cost between $10,300 and $12,600, with federal tax credits, and the average price per watt ranges from $2.32 to $2.83.

Will Florida pay for solar panels?

Most Florida residents qualify for the Federal Solar Investment Tax Creditâalso known as the solar ITC. This allows qualifying homeowners to deduct up to 26% of their solar panel installation costs from their federal income taxes. Many Florida homeowners also bundle battery storage with their solar panel system.

How much does solar panels pay in Florida?

| System size | System cost | System cost after federal tax credit |

|---|---|---|

| 8 kW | 20,480 dollars | 15,096 dollars |

| 9 kW | 23,040 dollars | 16,867 dollars |

Does Florida offer incentives for solar panels?

Florida Solar Panel Rebates and Tax Credits There are no statewide solar panel rebates in Florida. However, tax credits can make installation more affordable. Sales Tax Exemption: Under Florida’s Solar and Cogeneration Sales Tax Exemption, Florida residents are exempt from paying the 6% sales tax on solar panels.

Is it worth going solar in Florida?

Bottom Line: Is Solar Energy Worth It in Florida? With the cost of solar equipment lower than average and energy consumption much higher than in most states, most Floridians find solar energy to be a worthwhile investment.