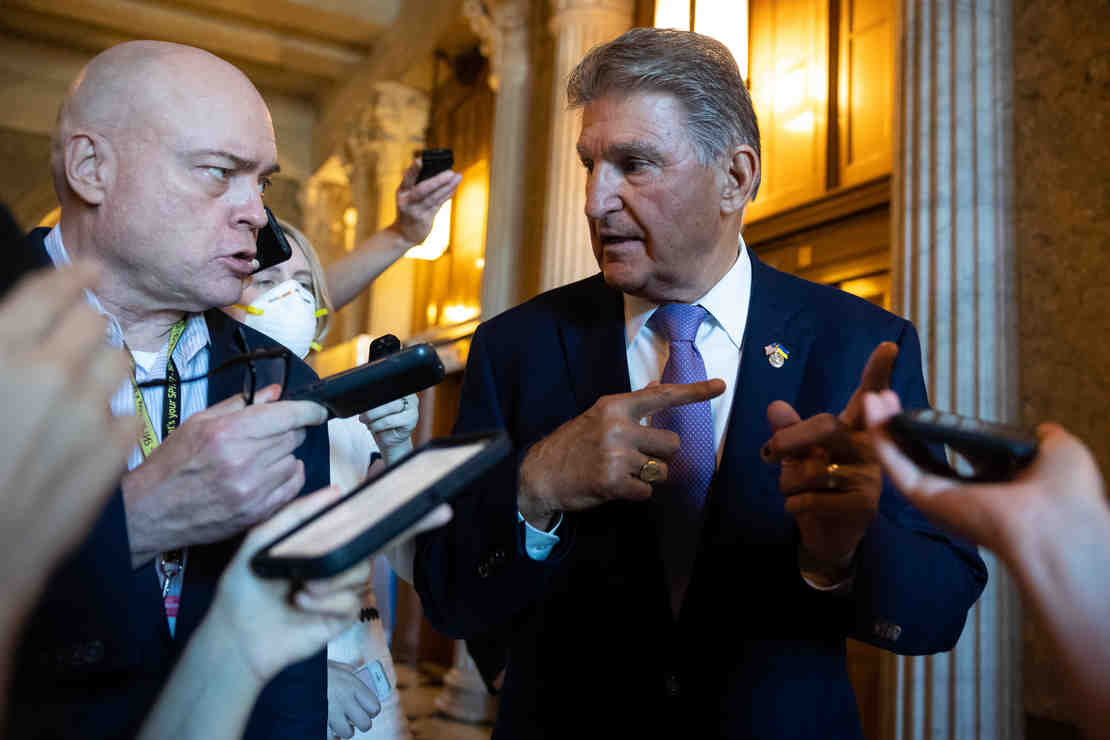

The surprise climate deal struck between Democratic Sens. Joe Manchin (W.Va.) and Chuck Schumer (N.Y.) this week could transform the U.S. energy sector, slashing emissions and delivering historic investments in clean technologies — though it meets many demands from GOP lawmakers . and conservative Democrats on fossil fuels.

The $369 billion “Inflation Reduction Act” contains new financial provisions and broad policy changes for nearly every segment of the energy sector, including wind, solar, hydrogen, carbon capture and oil and gas.

In a press conference yesterday, Manchin framed the new agreement – which would force the White House to hold several foreign lease sales – as a measure to strengthen US energy security.

“You have to be energy independent if you want to be a superpower in the world. That’s what China is doing and that’s what Russia had, and they are our two nemeses now,” he said.

The deal is packed with incentives to boost low-carbon technologies, including delivering tax code reforms sought for years by renewable industries, chief among them a 10-year extension of wind and solar tax credits.

It would also offer new tax credits for domestic manufacturing of solar panels, wind turbine parts and other key equipment for renewable energy growth. Energy storage projects located separately from renewable generation would also take advantage of a new investment tax credit.

For federal land programs, the bill is a mixed bag of reforms and mandates: Answering the call of offshore wind proponents, the measure would undo a Trump-era moratorium on offshore wind leasing that bars new auctions in the South Atlantic. Abandoned, the moratorium would likely hamper the growth of the industry, according to observers.

On the other hand, the connection of renewable provisions with new leasing for oil and gas has aroused opposition from many climate and reform advocates.

Autumn Hanna, vice president of Taxpayers for Common Sense, an organization that has pushed for federal oil and gas reforms for decades, said that approach could limit the Interior Department’s ability to make good decisions on federal lands.

“Those general policies on the surface seem very problematic,” she said, noting that the organization is still reviewing the text.

While the bill is being hailed as the most significant climate bill in American history, its actual effects on renewable deployment and emissions reductions are still being analyzed.

One U.S. Energy Information Administration analysis posted yesterday suggested that extending the investment tax credit to 2050 alone would lead to a 10 percent increase in solar power in the nation — though the bill’s tax code incentives would extend far beyond the ITC.

Schumer said the bill would lead to a 40 percent reduction in the country’s coal emissions by 2030, and represented “a historic advance on deficit reduction to fight inflation, invest in domestic energy production and manufacturing.”

His estimate of emission reductions aligned with those of some analysts.

Rhodium Group Associate Director Ben King said in an email that the bill could “plausibly” put the country on track for a 40 percent emissions reduction, citing previous modeling. In a note yesterday, Rhodium said the new package could reduce emissions 31 to 44 percent below 2005 levels in 2030, compared with 24 to 35 percent under current policy.

Jesse Jenkins, an assistant professor at Princeton University who leads an energy modeling collaboration known as REPEAT, said that while he and his colleagues were still reviewing the details of the bill, initial estimates indicated that it would “probably reduce emissions to about 40 percent below the top of the US emissions” in 2005 if proclaimed.

“Without this bill, we would be hopelessly far from our climate goals. I really hope they get this across the finish line and to President Biden’s desk right away,” he added in an email.

Biden, who has staked much of his climate legacy on Democrats passing major legislation, urged lawmakers to pass the bill in remarks yesterday at the White House.

“Let me be clear: This bill would be the most significant piece of legislation in history to address the climate crisis,” he said. “This bill is far from perfect. It’s a compromise. But it is often how progress is made. … Pass it on to the American people. Pass it for America.”

Manchin also called for swift passage, saying he worked closely with Senate Republicans on allowing reforms and other aspects of the bill that could drive bipartisan support.

“It’s going to have to be all politics to get them to oppose it,” he said.

Republicans attacked the plan, saying it would worsen inflation.

“Democrats have outlined a gigantic package of huge new job-killing taxes, Green New Deal madness, that will kill American energy,” Mitch McConnell (R-Ky.) said yesterday on the Senate floor. “Reckless taxation and spending spree that will delight the far left and hit working families even harder.”

Here are six ways the bill could dramatically change the energy sector, including by changing policies with oil and gas, renewables, carbon capture, methane, transmission and hydrogen:

Oil and gas

Along with many policies aimed at climate, the bill has provisions that would boost oil and gas, sparking frustration from activists but aligning with Manchin’s priorities — and his attempts to mollify GOP lawmakers and avoid partisan opposition. To see also : The Dark Side of Solar Energy: A Middle Tennessee Couple’s Warning to Others.

Perhaps most importantly, the package would force the president to reinstate last year’s Gulf of Mexico oil auction, which was vacated by a federal judge. It would also force three more offshore sales, two in the Gulf and one off the coast of Alaska, that were canceled by the White House earlier this year.

However, the language stops short of dictating specifically what the Biden administration does with its pending five-year offshore leasing plan, which will govern oil and gas leasing beyond this administration.

Erik Milito, president of the National Ocean Industries Association, said the bill is a compromise “based in reality” and “a serious path forward that elevates offshore energy of all kinds, for the betterment of our nation.”

Shell PLC CEO Ben van Beurden said on a conference call with reporters that he was pleased to see that the bill includes future leases for offshore oil exploration.

Van Beurden and others in the industry have argued that the world’s oil producers need to invest more in new oil and gas sources to help lower the price of fuel. Many experts have also noted the need for climate policymakers to focus on reducing demand for oil and gas rather than production, as cutting the supply of oil can have far-reaching economic consequences.

“In countries like the United States, which themselves have very strong domestic supply, just reducing domestic supply in the hope that somehow domestic demand will follow suit is not a realistic policy,” van Beurden said. “If you persist in basically shorting supply, the only thing that’s going to happen is you’re going to import it from somewhere else.”

But with growing climate risks weighing on society, several groups have criticized the package of oil and gas deals.

“This so-called deal forced by Senator Manchin is what we would expect when Congress is so closely divided and friends and profiteers of the fossil fuel industry have effective control over ‘climate’ policy,” said Food & Water Action Executive Director Wenonah Hauter in a statement. “We must not accept deals that strengthen the oil and gas industry to the detriment of all of us.”

The bill would also dramatically reform the oil and gas program through royalty tax increases. The offshore oil and gas royalty would be set at 16.66 percent – with a maximum also over 10 years of 18.75 percent.

On land, the bill would strike the minimum oil and gas royalty set in 1920 of 12.5 percent and replace it with 16.66 percent. This is a considerable increase, although less than what the Greens were pushing for.

Bonding will also increase, as will fees. Additionally, for the first time on public lands, the bill proposes paying a royalty on released methane — unless it is vented or flared for safety reasons or used on-site, such as for producing electricity at a well.

Hanna with Taxpayers for a Common Race said the reforms add up to a boon in terms of federal oil revenues.

“We’re definitely talking about real revenue here,” she said, noting a recent estimate by her organization that the federal government has missed out on as much as $13 billion in royalty revenue over the last 10 years alone by not increasing royalty rates on public lands. to 18.75 percent.

But the reforms have angered already disgruntled members of the oil and gas sector, who argue the changes will kill oil and gas activity on federal lands.

Steve Degenfelder, a landowner with Kirkwood Oil and Gas in Casper, Wyo., said the deal is “not good for small companies” while also doing nothing for gas prices and inflation.

“It should be called the ‘O&G Research Reduction Act,'” he said.

‘An enormous sigh of relief’ for renewables

Perhaps the biggest energy beneficiaries of the package would be wind and solar, which have found their way into the US mainstream and are now looking to supercharge deployment. To see also : San diego solar loans.

Wind and solar projects would effectively receive a 10-year extension of tax credits for production and investment, while stand-alone energy storage would also benefit through that period. In 2025, the existing production credit would transform into a technology-neutral version that could be claimed by wind, solar or storage companies.

That basic tax benefit could increase if developers also implemented new standards for labor, made-in-America sourcing or environmental justice. For example, solar, wind and storage facilities built especially for low-income communities could benefit from an increased credit of up to 20 percent.

Any company that sought to claim the long-term credits, meanwhile, would have to pay its workers the equivalent of the prevailing wage or face penalties.

One casualty of negotiations was a separate investment tax credit for transmission lines — something many grid and renewables experts said was important to improving the efficiency of a clean energy transition.

Another main request from renewable industries – direct payment options for developers – would be limited to tax-free entities in the case of wind, solar and storage, according to a breakdown of the bill provided by the American Clean Power Association (ACP).

Across the board, renewable representatives said the bill would unleash growth and begin a new chapter for their industries.

Heather Zichal, CEO of ACP, called it “America’s biggest legislative moment for climate and energy policy” in a statement sent shortly after the breakthrough was announced Wednesday night.

“The entire clean energy industry just breathed a huge sigh of relief. This is 11th hour relief for climate action and clean energy jobs,” she said at the time.

In a separate statement Wednesday, Greg Wetstone, president and CEO of the American Renewable Energy Council, said it appears Congress is “finally rising to meet the climate challenge.”

Abigail Ross Hopper, president and CEO of the Solar Energy Industry Association (SEIA), predicted yesterday that the bill’s tax credit extensions are likely to “move us the furthest of the way to our climate goals.”

Independent renewable analysts had a similar view. Pol Lezcano, chief analyst for North American solar at BloombergNEF, said the solar tax credits have proven to be “a big deal and make the economics of solar especially attractive in states with large solar resources,” though his firm has not yet modeled how much. of acceleration the bill would give.

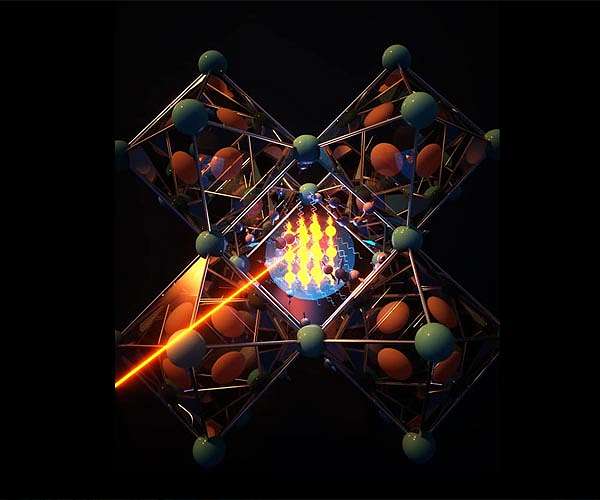

One new source of support for renewable sources will come through production tax credits offered to companies that make crucial off-source equipment, including battery anodes, solar cells and wind turbine blades.

Domestic producers could win new product tax credits that vary by the exact item, reaching deep into the supply chains to initial inputs like polysilicon and inverters, along with processing dozens of critical minerals.

The credit would also be claimable for offshore wind vessels – targeting the ballooning demand for vessels to build and service offshore wind farms planned on the Atlantic coast.

However, the tax policies could prove particularly significant for the solar industry, which has been hit in the past year by bitter infighting over trade policy and allegations of forced labor in the Chinese supply chain (Energywire, April 6).

One source of turmoil was a Commerce Department investigation into tariffs on solar equipment from four Southeast Asian countries that make up the majority of imported panels.

Requested by California panel maker Auxin Solar in February, the survey was widely blamed for freezing industry growth this year until Biden issued a preemptive two-year waiver on any new solar tariffs (Energywire, June 7).

Biden’s tariff move angered Auxin and its supporters, who called it a poor substitute for industrial policy and said it would give a free pass to Chinese subsidized producers.

But yesterday, Auxin CEO Mamun Rashid applauded the new bill’s provisions for US solar manufacturers, saying it would be a “major catalyst” for the company’s own expansion.

“The law provides the certainty that we must invest in new machinery and start producing at scale. We are very happy that this will become law and fully support the efforts to ensure its approval by Congress,” said Rashid in a statement.

Nick Iacovella, senior vice president of communications at the Coalition for a Prosperous America, which supported Auxin’s tariff request, said the bill would be a “huge victory for U.S. solar manufacturers” if it becomes law.

However, Rashid said the subsidies for U.S. solar manufacturers would not diminish the importance of Commerce’s tariff investigation.

“What we know is that we cannot oversubsidize China. Although this law gives certainty that the US government supports the production of renewables here, China will not stop in its desire to be the global power in solar,” he added.

Solar developers, who have consistently opposed tariffs on panel imports, said the bill would offer incentives that would ultimately allow for more robust, more reliable growth in U.S. solar manufacturing — a field that has waxed and waned over the years.

SEIA’s Hopper said the bill would lead to “transformational investments” in American companies. Within two or three years, she said, American companies will open factories for everything from solar panels to inverters, and within five years, other components — ingots, wafers and cells — would follow.

“[We’ve] had many conversations with manufacturers who tell us this is exactly what they need to increase their investments in domestic manufacturing,” Hopper said in a statement.

Her expectations were largely echoed by BNEF’s Lezcano, who said that while wafer and cell plants have tended to take longer to build, they are likely to follow on from the boom in US module factories.

Hydrogen’s big break?

In addition to targeting traditional renewable energies, the bill could lay an important foundation for the emergence of new technologies seen as part of the low carbon toolkit of the Biden administration.

DOE’s Office of Loan Programs, for example, would receive $3.6 billion in replenished authority for its loan guarantees that support innovative but hard-to-finance types of low-carbon energy.

One such technology—”clean” hydrogen—would also get access to a new production tax credit, something advocates saw as crucial to the technology’s development (Energywire, July 27).

The package would define “clean” hydrogen as resulting from any process that emits 4 kilograms or less of CO2 for every kilogram of hydrogen.

That’s just under half the typical CO2 emissions associated with hydrogen made from natural gas, the most common form of the fuel today.

At the 4-kilogram level of emission, producers could claim 20 percent of the full tax credit.

Those who emitted less could receive an increasing proportion of the credit, culminating in the full 60 cent credit per kilogram of hydrogen – the level that could be claimed if production involved 0.45 kilogram of CO2 or less.

Dan Esposito, senior policy analyst at Energy Innovation, said the bill appeared to promote decarbonization of existing “dirty” hydrogen production facilities, through carbon capture.

Producers of “green” or renewable hydrogen, he added, could also claim a much larger tax credit, giving them momentum to launch the first large-scale installations.

He noted that the life cycle emissions would be calculated in a way that would include drilling and transport of natural gas, if the hydrogen was produced using that fuel.

Jeff Bechdel, a spokesman for Hydrogen Forward, said his coalition was “very pleased to see this incentive,” along with a tax credit for fuel cell vehicles.

“This will encourage further growth in clean hydrogen, which will play a critical role in addressing hard-to-decarbonize sectors such as transportation, heavy industry, agriculture and power generation,” he wrote in a statement. The coalition’s membership includes several hydrogen producers and equipment makers as well as fuel cell vehicle manufacturers.

Some researchers, however, criticized what they saw as “very troublesome” permits for carbon emissions and the bill’s lack of limits on how the hydrogen would be consumed.

“Although the bill provides a higher incentive for less carbon-intensive hydrogen, there is no other incentive for producers to pursue cleaner forms of hydrogen production,” said Abbe Ramanan, project director at the nonprofit Clean Energy States Alliance and Clean Energy Group.

“Given the research that is just coming out about the serious climate impact of hydrogen, this is incredibly short-sighted,” she added in an email.

Carbon capture and storage

The legislation includes some proposed changes to the federal 45Q tax credit, an incentive that provides monetary value per ton of carbon dioxide that is captured and stored, either in safe geological formations or through enhanced oil recovery.

Under the bill, modifications to 45Q include extending the deadline for carbon capture projects — as well as direct air capture or carbon utilization projects — to begin construction and continue to qualify for the credit. The measure would move the “initial construction” deadline from late 2025 to late 2032.

“Extending the initial construction window to qualify for 45Q would establish a much-needed investment horizon to give carbon management projects the time they need to scale between now and midcentury,” Madelyn Morrison, director of external affairs for the Carbon Capture Coalition, said in an email. statement

Other major changes to the tax credit include higher credit values for the industrial and power sectors — something groups like the Carbon Capture Coalition, a collection of more than 100 organizations that support greater CCS deployment, have been pushing since last year.

The bill would raise the value of 45Q for industrial facilities and power plants that capture their carbon emissions to $85 per ton for CO2 stored in safe geological formations, $60 per ton for the beneficial use of captured carbon emissions and $60 per ton for CO2 stored. through enhanced oil recovery in oil and gas fields, according to a summary provided by the coalition.

The current credit value is $50 per ton that is sequestered geologically and $35 per ton stored through enhanced oil recovery.

The Carbon Capture Coalition called the changes to 45Q “monumental improvements” in a statement, saying they could lead to greater deployment of different carbon management technologies, while some groups called for the controversial tax credit to be scrapped altogether.

45Q is “a gift to polluters that strengthens and extends the life of emitting facilities like coal plants just when we urgently need to transition away from fossil fuels,” said Steven Feit, a senior attorney at the Center for International Environmental Law.

“The tax credit should be eliminated, not expanded or extended,” Feit said.

The comments underscore tension that continues around carbon capture, where carbon dioxide emissions are captured from point sources such as ethanol or power plants before they can enter the atmosphere.

Supporters of carbon capture argue that changes to the tax credit are necessary, especially without a price on carbon, to increase the number of projects nationwide. But opponents of the technology point out that carbon capture does not address emissions of methane, for example, either from coal mines or during natural gas production.

A study published by the University of Wyoming earlier this month said that while the current level of 45Q helps lower carbon capture costs, it is “not sufficient to promote widespread deployment of CCS.”

“To improve the viability of CCS retrofits substantially, the Section 45Q tax credit for geological sequestration should be increased to $85 or higher per ton of CO2 with the payback period of up to 20 years,” said the study, which focused on deployment in Wyoming.

John Larsen, a partner at the Rhodium Group, said in a briefing yesterday organized by the Center for American Progress that proposed adjustments to 45Q are “a big deal”.

In addition to giving developers more time to be credible, Larsen said increasing the 45Q value would “unlock a much more diverse set of opportunities for carbon capture,” especially for hard-to-treat sectors like cement and steel.

On the same call with reporters, Leah Stokes, a professor at the University of California, Santa Barbara, said that beyond the industrial sector, carbon capture can help address CO2 emissions from a new wave of planned natural gas power plants.

“When it comes to the power sector, there are 220 proposed gas plants that have no carbon mitigation whatsoever,” Stokes said.

“If we build a lot of gas plants that don’t have some kind of capture technology, that’s not going to be good news,” Stokes added later. “So whether or not we see deployment in the power sector is, I think, a question mark, but it could potentially become a viable technology in the margins in the power sector.”

Other proposed changes to 45Q in the legislation include a direct payment option, where “companies can choose a cash payment rather than a deduction from their tax liability,” according to the Carbon180 group.

“The [bill] would allow [direct air capture] developers to receive direct compensation … for credits generated in the first five years — allowing recipients to benefit from credits regardless of what they owe in taxes,” said Rory Jacobson, deputy director of politics at Carbon180, in a statement.

“This is particularly important to ensure that the credit can be accessed by startups and smaller businesses that have a low tax rate,” added Jacobson.

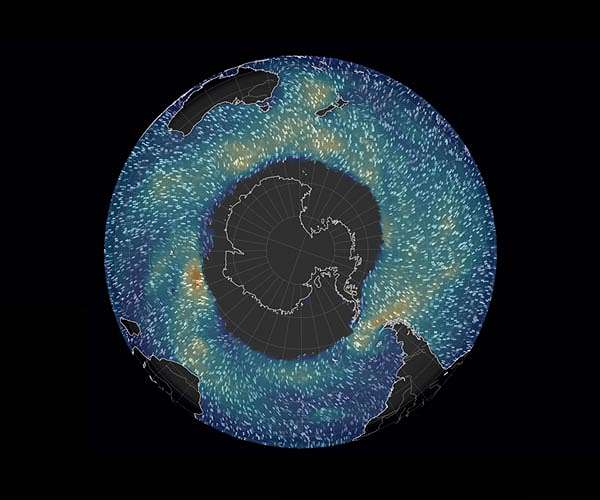

Transmission’s ‘bizarre process’

The Schumer-Manchin proposal does not include a new investment tax credit (ITC) for long-distance high-voltage transmission lines proposed by some congressional lawmakers and approved by the Biden administration.

That proposal was a top priority of the advocacy group Americans for a Clean Energy Network, which said its previous tax breaks to investors would jump-start long-delayed power line projects connecting major wind and solar sites to population centers.

A report issued by the American Renewable Energy Council in May 2021 by Rob Gramlich and Michael Goggin of Grid Strategies LLC singled out 22 long-distance transmission projects with an estimated total cost of $33 billion that were well advanced in planning but held up by location. and allowing obstacles.

Half of these are likely to qualify for the 30 percent ITC proposed by House and Senate sponsors, limited to “regionally significant” lines, the ACORE report estimated. If fully used for renewable energy, the lines could deliver 30 gigawatts of carbon-free power, the report said.

Gramlich called a transmission tax credit a top clean energy priority.

“The ITC is what both utilities and merchant developers have said they could use to deploy transmission, so it’s very unfortunate that it didn’t go in,” Gramlich said.

While some transmission developers likely can benefit from the federal loan guarantees included in the Schumer-Manchin plan, “many cannot,” Gramlich said in an email yesterday.

“This legislation has been a bizarre process to say the least,” he added.

Princeton’s Jenkins saw the loss of the ITC proposal in less damaging terms.

“Cost is not the key barrier for transmission lines. There are many, cost-effective projects that are simply not being built. The real barriers are siting and permitting times and cost allocation,” Jenkins said in an email. The tax credit makes financing a little easier, but probably isn’t a difference maker for building lines, he added.

Methane fee

The bill would also put a fee on excess methane emissions from oil and gas companies, charging operators if they emit more than 25,000 tons of carbon dioxide equivalent per year.

The “methane fee” would increase from $900 per metric ton of emissions reported for calendar year 2024 to $1,500 per emission reported for calendar year 2026 “and each year thereafter,” the legislation said. The methane fee would apply to various “application” facilities, including for offshore and onshore oil and gas production and liquefied natural gas import and export.

Kathleen Sgamma, president of the Western Energy Alliance — whose members operate on public and private lands across the West — said the specified dollars per ton fees are “arbitrary and unsupported.”

“Government technicians haven’t figured out how to set a meaningful cost of carbon that isn’t a lump sum and these costs per ton are arbitrary,” Sgamma said in an email.

“Emissions are something that should be controlled and reduced, not treated as a revenue source for the government,” Sgamma continued. “Taxing emissions regulated under the Clean Air Act is unprecedented and amounts to double jeopardy.”

However, Peter Zalzal, senior adviser and associate vice president for clean air strategies at the Environmental Defense Fund, said the fee “reflects the economic damage that methane pollution causes to communities and the climate, and $1,500 per ton is currently accepted [estimate ] of the damages produced by methane pollution.”

However, Liz Bowman, spokeswoman for the American Exploration & Production Council said the group does not support a methane fee and directed E&E News to a September 2021 blog post written by Anne Bradbury, the CEO of AXPC.

“While we are still digesting the 700+ pages of legislative text, we are very concerned about the potential negative impact of this bill on energy prices and American competitiveness, especially in the midst of a global energy crisis and record high inflation,” Bradbury said. . statement yesterday.

Similarly, Amanda Eversole, chief advocacy officer at the American Petroleum Institute, said in a statement that the trade group opposes “policies that increase taxes and discourage investment in America’s oil and natural gas.”

Todd Staples, president of the Texas Oil & Gas Association, said the group hopes the nation can focus on policies that encourage infrastructure development, such as removing barriers to permitting and focusing on oil and natural gas produced in the United States.

Aaron Weiss, deputy director at the Center for Western Priorities, said in an email that he suspects “any pushback on a methane fee will expose the gap between large and small producers.”

“The big companies are fine with it, it’s the smaller drillers who want to be free to fire up and get out,” Weiss said, adding, “I’m optimistic that all of these supplies will survive any attempts to water down the bill.”

Reporters Mike Lee and Camille Bond contributed.