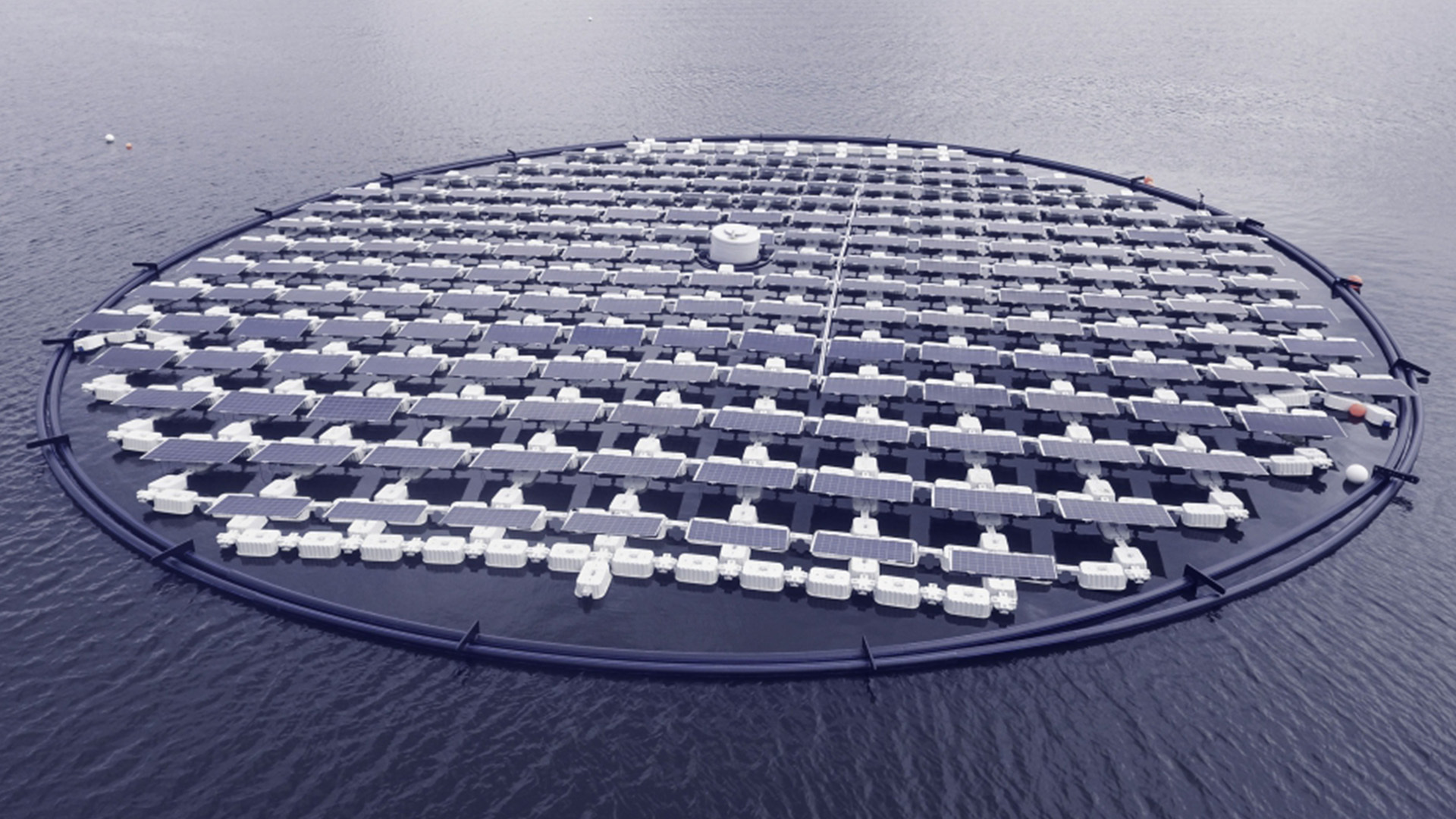

New Delhi: India’s solar panel imports are set to remain higher in financial year 2023-24 (FY24) as compared to FY23 owing to upcoming solar power capacities planned till FY26 and how the situation around ALMM evolves, according to industry experts.

During the initial six months of FY24, India saw a surge in solar module imports, reaching a substantial $1,136.28 million. This surpassed the total PV panel imports for the entire FY23, which amounted to $943.53 million, according to Eninrac Consulting.

Vikram V, vice-president, co-group head – corporate ratings, ICRA, said the reason behind this is two-fold. The government has put restrictions on usage of directly imported modules for projects under the approved list of models and manufacturers (ALMM) where the modules had to be procured from domestic players.

“From March 2023, the Order has been put on abeyance till March 2024 wherein the developers can import the modules directly. The other reason is the sharp reduction in solar module and cell prices has led to the sharp rise in imports in the current financial year,” said Vikram.

He added that this year the imports will remain higher in FY24 as compared to FY23.

“What happens to solar imports after March 2024 depends on how the situation around ALMM evolves… But even then imports will be there but they will be restricted to solar cells while modules will have to be procured domestically,” said.

The estimated solar module imports in India for FY23 was 2.6 GW and for FY24 till October 24 was 8.9 GW, according to the research consultancy. It added that the estimated MW imports were drawn by assuming an average price per MW of solar panels.

According to Ravi Shekhar, director, Eninrac Consulting, although domestic manufacturing is ramping up in India, it is still far from serving the annual demand generated for panels in the country which in turn necessitates imports.

“The extent of imports is likely to follow a similar trend as displayed in the past 18 months owing to the upcoming solar capacities planned till FY26, quantifying a volume of 18.9 GW. This means nearly 9.5 GW on an annual basis shall be required in the coming two financial years – unless otherwise fresh capacities are announced in the near future – signaling close to 75 per cent to 80 per cent of capacity added in FY23,” said Shekhar.

He, however, added that the overall volume of imports might decline, though imports at large will serve the Indian demand with a transition likely to be recorded from China to other countries such as Vietnam, Malaysia, Thailand, and Hong Kong in the mix as well.

China maintained its position as the primary contributor to the Indian market, supplying solar panels valued at $501.9 million in H1 FY24, in contrast to $874.89 million during the 12 months of FY23, according to Eninrac Consulting.

It added that following China, Vietnam and Hong Kong emerged as significant suppliers, delivering modules worth $455.8 million and $121.82 million in the first half of FY24, a considerable increase from $39.63 million and $3.04 million in FY23, respectively. H1 FY24 saw imports from Malaysia totaling $43.08 million.

Shifting focus to PV cells, not assembled in modules or panels, India’s imports in H1 FY24 amounted to $1,005.07 million, a decline from $1,310.28 million in the 12 months of FY23.

China remained the principal supplier, contributing shipments valued at $499.98 million, followed by Malaysia at $264.19 million, and Thailand at $138.07 million, noted the consultancy.

Published On Dec 25, 2023 at 06:01 AM IST

Join the community of 2M+ industry professionals

Subscribe to our newsletter to get latest insights & analysis.

Download ETEnergyworld App

Get Realtime updates

Save your favourite articles

Scan to download App