We’ve detected unusual activity from your computer network

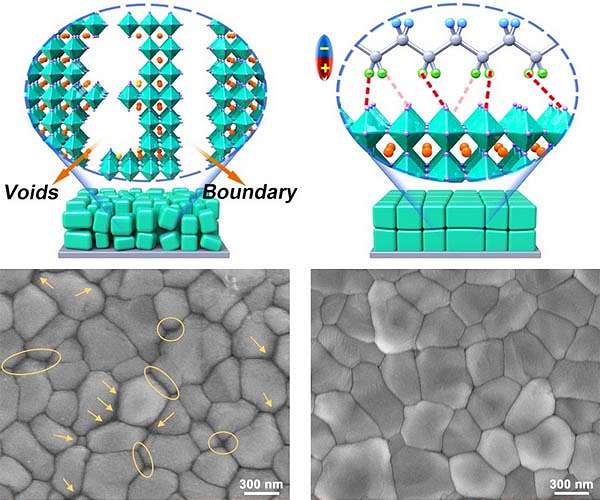

To continue, please click to the box below to tell us you’re not a robot. To see also : Use of perovskite will be a key feature of the next generation of electronic appliances.

Why did this happen?

Please ensure that your browser supports JavaScript and cookies and that you do not block them from loading. To see also : What solar energy meaning ?. For more information, you can review our Terms of Service and Cookie Policy.

Need Help?

For inquiries related to this message please contact our support team and enter the reference ID below.

How many years can you claim solar tax credit?

You can claim the federal solar tax credit as long as you are a US homeowner and own the solar panel system installed at a residence in the US. The tax credit rolls over for up to five years if the taxes you owe are less than the credit you earn.

How does solar tax credit work if I get a refund? If you paid $5,000 and your tax return is $3,000, you have now only paid $2,000 in taxes. You solar tax credit cancels this $2,000 and adds it to your refund check. The remaining $1,000 solar tax credit is deducted from next year’s taxes or whatever year you owe again.

How does IRS verify solar credit?

Filing Requirements for the Solar Tax Credit To claim the credit, you must file IRS Form 5695 as part of your tax return. You calculate the credit on Part I of the form, and then enter the result on your 1040.

Does IRS audit energy credits?

A review by the Treasury’s tax administration inspector general found that the IRS was not accurately tracking and calculating home energy credits. The IRS does not require third-party documentation proving that taxpayers actually purchased qualifying home improvements or that improvements were made to a principal residence.

What documents are needed for solar tax credit?

Claiming the ITC is easy. To get started, you first need your standard IRS Form 1040, IRS Form 5695, âResidential Energy Credits,â and the Instructions for Form 5695. The purpose of Form 5695 is to validate your qualification for renewable energy credits. .

How does the solar tax credit work IRS?

The solar investment tax credit is a credit you can claim on your federal income tax. The ITC is not a tax return. Instead, it reduces what you owe in taxes. This credit applies to the costs associated with the installation of a solar photovoltaic (PV) system in that tax year.

How does solar tax credit work?

If you install a solar system in 2021 or 2022, 26% of your total project costs (including equipment, permitting and installation) can be claimed as a credit on your federal tax return. If you spend $10,000 on your system, you will owe $2,600 less in taxes next year.

Can I claim the solar tax credit more than once?

How often can you claim the solar tax credit? You can only claim the solar tax credit once for your solar energy installation. If you have an unused amount left on your tax credit that you cannot claim in a single tax year, you can carry forward that tax credit value for up to five years.

How long do solar panels last?

Solar panels, also known as photovoltaic or PV panels, are made to last more than 25 years. In fact, many solar panels that were already installed in the 1980s are still at the expected capacity. Solar panels are not only remarkably reliable, the longevity of solar panels has increased dramatically over the last 20 years.

Solar panels need to be cleaned? Solar panels do not need to be cleaned, but you will sacrifice some efficiency by not cleaning them. And while rain does wash away certain substances that accumulate on the panels, it is not as effective as manual cleaning.

How long do solar panels take to pay for themselves?

Solar panels pay for themselves over time by saving you money on electricity bills, and in some cases, you earn money with ongoing incentive payments. Solar panel payback time averages between 5 and 15 years in the US, depending on where you live.

What are the 2 main disadvantages to solar energy?

Disadvantages of solar energy

- costs. The initial cost of buying a solar system is quite high. …

- Weather-dependent. Although solar energy can still be collected during cloudy and rainy days, the efficiency of the solar system decreases. …

- Solar energy storage is expensive. …

- Uses a lot of space. …

- Related to pollution.

How often does solar need to be replaced?

In general, solar panels are extremely durable and with no moving parts, they usually require little to no maintenance. As of now, the average lifespan of residential solar panels is around 25-30 years, but some systems can even last 50!

How do you incentivize solar energy?

Great solar discounts and solar incentives

- Investment tax credits.

- State tax credits.

- Cash discount.

- Solar Renewable Energy Credits (SRECs)

- Performance-based initiatives.

- Incentives for businesses.

- Subsidized loans.

- Tax reliefs.

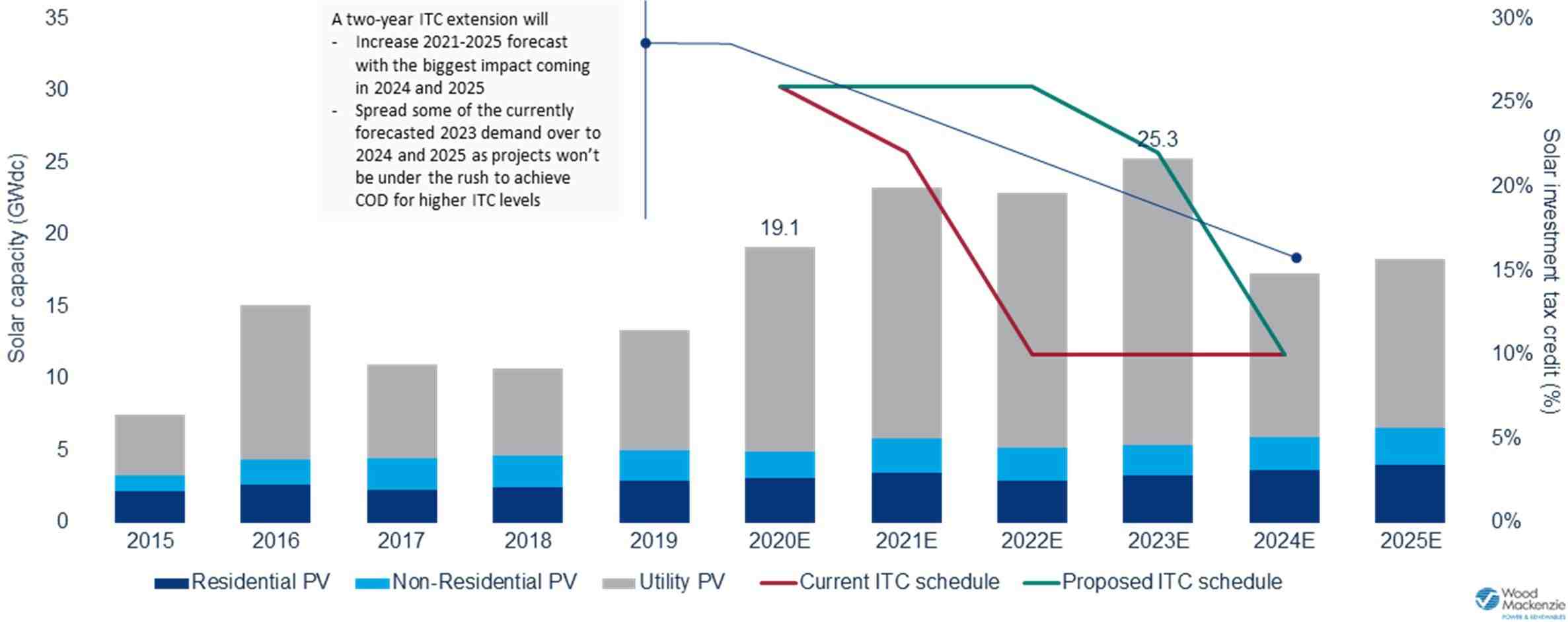

How do you incentivize solar panels? You can qualify for the ITC for the tax year that you installed your solar panels as long as the system generates electricity for a home in the United States. In 2021, the ITC will provide a 26% tax credit for systems installed between 2020 and 2022, and 22% for systems installed in 2023.

How does the solar tax incentive work?

Federal Solar Tax Credit â December 2021 Update If you install a solar system in 2021 or 2022, 26% of your total project costs (including equipment, permitting and installation) can be claimed as a credit on your federal tax return. If you spend $10,000 on your system, you will owe $2,600 less in taxes next year.

Is the 26% solar tax credit refundable?

Will I get a refund? This is a non-refundable tax credit, which means you will not receive a tax refund for the amount of the solar tax credit that exceeds your tax liability. However, you can carry over any unused amount of solar tax credit to the next tax year.

How does the solar incentive work?

Solar rebates work just like rebates for other consumer purchases. You buy a new PV system, mail in a form, and get cash back. It’s a very simple strategy to reduce the upfront cost of your installation by 5%, 20% or more.

How much do you get back in taxes for solar panels?

In December 2020, Congress passed an extension of the ITC that provides a 26% tax credit for systems installed in 2020-2022, and 22% for systems installed in 2023. (Systems installed before December 31, 2019 were eligible for a 30% tax credit .)

What incentives can we use to promote the use of renewable energy?

The federal tax incentives, or credits, for qualifying renewable energy projects or equipment include the Renewable Electricity Production Tax Credit (PTC), the Investment Tax Credit (ITC), the Residential Energy Credit, and the Modified Accelerated Cost-Recovery System (MACRS).

Is solar a tax write off?

Yes. Generally, you can claim a tax credit on the expenses related to the new solar PV system already installed in the house for the year in which you moved into the house (assuming the builder did not claim the tax credit ) – in other words, you can apply for the credit in 2021.