How long do solar panels last?

Solar panels, also known as photovoltaic or photovoltaic panels, are made to last over 25 years. In fact, many solar panels installed since the 1980s are still operating at expected capacity. Not only are solar panels remarkably reliable, but solar panel longevity has dramatically increased over the past 20 years.

How often do solar panels need to be cleaned? How often should you clean solar panels? Generally, it is recommended to clean solar panels every 6 months to a year to maintain the productivity, efficiency and effectiveness of the panels. To see also : China Tests Technology That Can Drive Solar Energy From Space to Earth. However, depending on where you live and the level of dirt and pollution, the need for cleaning may be more frequent.

How often do you have to replace solar?

Generally speaking, solar panels are extremely durable and with no moving parts, they usually require little to no maintenance. This may interest you : Solar turbines san diego news. As of now, the average lifespan of solar panels for home is around 25-30 years, however some systems can last as long as 50!

Do solar cells require maintenance?

Do solar panels need maintenance? Solar panels usually require very little maintenance to work, so yes, you can usually leave them alone. The only thing they need is a light periodic cleaning to ensure dirt, leaves and other debris don’t clog the sun’s rays.

Should I wash my solar panels?

Solar panels don’t need to be cleaned, but you will be sacrificing some efficiency by not cleaning them. And while rain will certainly wash away certain substances that build up on the panels, it won’t be as effective as a manual cleaning.

Does cleaning solar panels make a difference?

On average, panels lost just under 0.05% of their overall efficiency per day. “Most homeowners won’t get their money back for hiring someone to wash their roof panels,” said Jan Kleissl, the study’s principal investigator and professor of mechanical and aerospace engineering at UC San Diego.

Does cleaning solar panels increase efficiency?

There is no doubt that cleaning your panels will increase your overall efficiency. According to many statistical observations, this improvement in efficiency and performance can be dramatic, up to 21% in residential arrays and up to 60% in commercial installations.

Is it safe to wash solar panels?

It’s best to approach cleaning the dashboard the same way you would clean your car. Detergent and warm water applied with a sponge or soft cloth is the safest and easiest cleaning method. It can also be helpful to use a squeegee to remove dirty water. Remember – avoid damaging or scratching the glass at all costs!

Do solar panels deteriorate over time?

The reduction in solar panel output over time is called degradation. NREL research has shown that solar panels have an average degradation rate of about 0.5% per year, but the rate can be higher in warmer climates and on roof systems.

Do solar panels get weaker over time?

Solar panel efficiency is higher than ever, but the amount of electricity the panels can generate still gradually decreases over time. High-quality solar panels degrade at a rate of about 0.5% each year, generating about 12-15% less energy at the end of their 25-30 year lifespan.

Do solar panels get better over time?

Main errands. Solar panel efficiency is a measure of a solar panel’s ability to convert solar energy into usable energy. The efficiency of solar panels has improved dramatically over time, and the panels continue to push new limits each year.

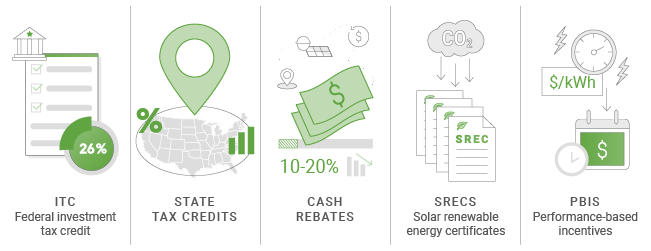

Will there be new incentives for solar?

Federal Solar Investment Tax Credit (ITC)** Buy and install a new residential solar system in California in 2022, with or without a home battery, and you could qualify for the 26% federal tax credit. Residential ITC drops to 22% in 2023 and ends in 2024.

Is solar energy tax deductible?

The investment tax credit (ITC), also known as the federal solar tax credit, allows you to deduct 26% of the cost of installing a solar energy system from your federal taxes. The ITC applies to both residential and commercial systems and there is no limit to its value.

How much solar panel is deductible? Since 2005, the federal government has encouraged homeowners to switch to solar through the Solar Investment Tax Credit (ITC), also known as the Federal Solar Tax Credit. This tax credit currently allows you to claim 26% of the total cost of installing your solar system on your federal taxes.

Is solar energy a tax write off?

Yup. You can generally claim a tax credit on expenses related to the new solar PV system that already came installed on the home for the year you moved into the home (assuming the builder did not claim the tax credit) – in other words, you can claim the credit in 2021.

How do I claim my solar on my taxes?

Filing Requirements for the Solar Tax Credit To claim the credit, you must file IRS Form 5695 as part of your tax return. You will calculate the credit in Part I of the form and then enter the result in your 1040.

What is the solar tax credit for 2021?

The Federal Investment Tax Credit (2021) In 2021, the ITC will provide a 26% tax credit on solar panel installation costs as long as your taxable income is greater than the credit itself. For most homeowners, this effectively translates to a 26% discount on their home’s solar system.

Can I write off solar as a business expense?

Business Energy Investment (ITC) Tax Credit Companies that install solar photovoltaic (PV) systems are eligible to receive a tax credit worth 26% of the total cost of the photovoltaic system. Unlike tax deductions, this tax credit can be used to directly offset your dollar-for-dollar tax debt.

What is the tax credit for solar in 2020?

In December 2020, Congress passed an extension to the ITC, which provides a 26% tax credit for systems installed in 2020-2022 and 22% for systems installed in 2023. 4 The tax credit expires from 2024 unless Congress to renew it.

Has the 26% solar tax credit been extended?

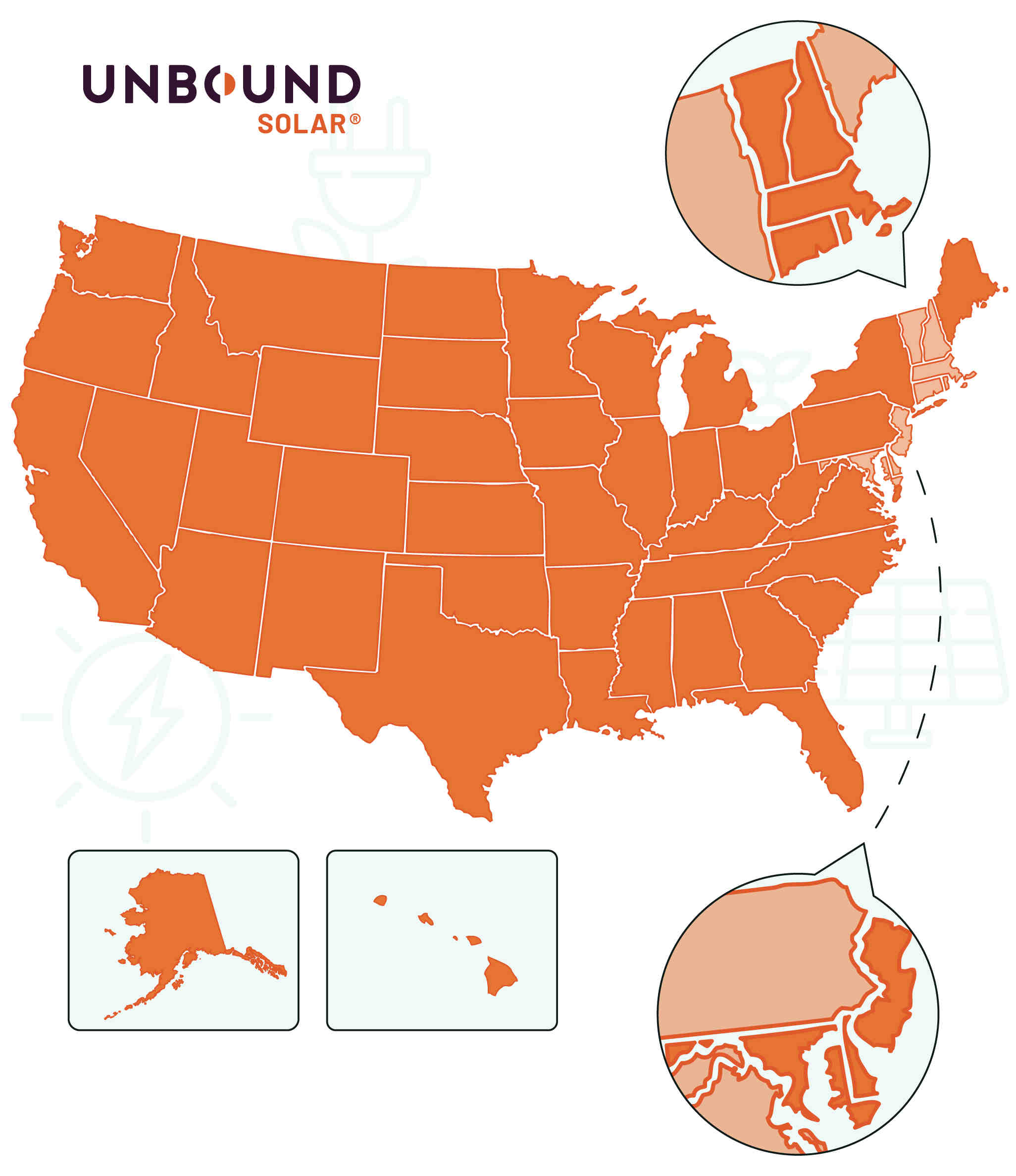

After the new congressional bill, the 26% solar tax credit is available until 2021 and 2022. In addition, the reductions to 22% and 10% have been postponed to 2023 and 2024. In addition to having low cost and low environmental impact , solar energy has created many jobs in the US economy.

What is the tax credit for going solar?

The Federal Investment Tax Credit, also known as the Solar Tax Credit, is a tax credit that allows you to deduct up to 26% of the cost of your solar energy system from your federal taxes.

What is the solar tax credit for 2021?

The Federal Investment Tax Credit (2021) In 2021, the ITC will provide a 26% tax credit on solar panel installation costs as long as your taxable income is greater than the credit itself. For most homeowners, this effectively translates to a 26% discount on their home’s solar system.

How do I claim my solar on my taxes?

Filing Requirements for the Solar Tax Credit To claim the credit, you must file IRS Form 5695 as part of your tax return. You will calculate the credit in Part I of the form and then enter the result in your 1040.

How do I deduct solar panels on my taxes?

To claim the solar tax credit, you first need to determine if you are eligible, complete IRS form 5695, and finally add your renewable energy tax credit information to Schedule 3 and Form 1040. Compare solar quotes on the EnergySage Marketplace to maximize your savings.

Do you get a refund for solar tax credit?

WILL I RECEIVE A REFUND? This is a non-refundable tax credit, which means you will not receive a tax refund for the amount of the solar tax credit that exceeds your tax liability. However, you can carry over any unused solar tax credit amount to the next tax year.

How much money do you get back from solar panels on taxes?

In December 2020, Congress passed an extension to the ITC, which provides a 26% tax credit for systems installed in 2020-2022 and 22% for systems installed in 2023. (Systems installed before December 31, 2019 were eligible for 30% credit fee.)

What are the 2 main disadvantages of solar energy?

Disadvantages of Solar Energy

- Cost. The initial cost of purchasing a solar system is quite high. …

- Weather Dependent. Although solar energy can still be collected during cloudy and rainy days, the efficiency of the solar system drops. …

- Solar energy storage is expensive. …

- Uses a lot of space. …

- Associated with pollution.

What is the main disadvantage of solar energy? Reliability. One downside of solar power is that it relies on the sun, electricity cannot be generated overnight, requiring you to store excess energy produced during the day or connect to an alternative energy source such as the local power grid. .

What are 2 pros and 2 cons of solar energy?

| pros of solar energy | Cons of solar energy |

|---|---|

| Reduce your electricity bill | Does not work for all roof types |

| Improve the value of your home | Not ideal if you’re about to move |

| Reduce your carbon footprint | Buying panels can be expensive |

| Fight rising electricity costs | Low electricity costs = less savings |

What are 2 pros of solar energy?

Solar energy is pollution free and does not cause greenhouse gas emissions after installation. Reducing dependence on foreign oil and fossil fuels. Renewable clean energy that is available every day of the year, even cloudy days produce some energy. Return on investment as opposed to paying utility bills.